We Started in a Café in 2019

Three finance professionals frustrated with academic theory that didn't work in real corporate environments. We wanted something practical.

So we built it ourselves. No fancy mission statements back then—just late nights turning case studies into something analysts could actually use.

What We Actually Do

We teach corporate finance the way it's practiced in real companies, not how textbooks describe it. That means messy data, incomplete information, and decisions that need to happen by Friday.

Most of our instructors still work in finance. They're bringing cases from last quarter, not last decade. When regulatory changes hit Argentina's financial sector in early 2025, we updated our curriculum within weeks because our team was dealing with those same changes at their day jobs.

This keeps us honest. And it means when you're learning valuation methods or risk assessment frameworks, you're getting the version that survived contact with actual corporate finance departments.

What Matters to Us

Reality Over Theory

We start with what works in actual finance departments and work backward to the concepts. Not the other way around.

Honest Limitations

We don't promise you'll become a CFO in six months. Finance careers take time, and we're upfront about what our programs can and can't do for your trajectory.

Peer Learning

Some of our best content comes from participant discussions. When someone figures out a better approach to scenario analysis, we share it with everyone.

How We Think About Teaching

Rodrigo leads most of our core programs. He spent eight years in corporate treasury before teaching, which shows. His sessions feel less like lectures and more like strategy meetings where he's walking you through how decisions actually get made.

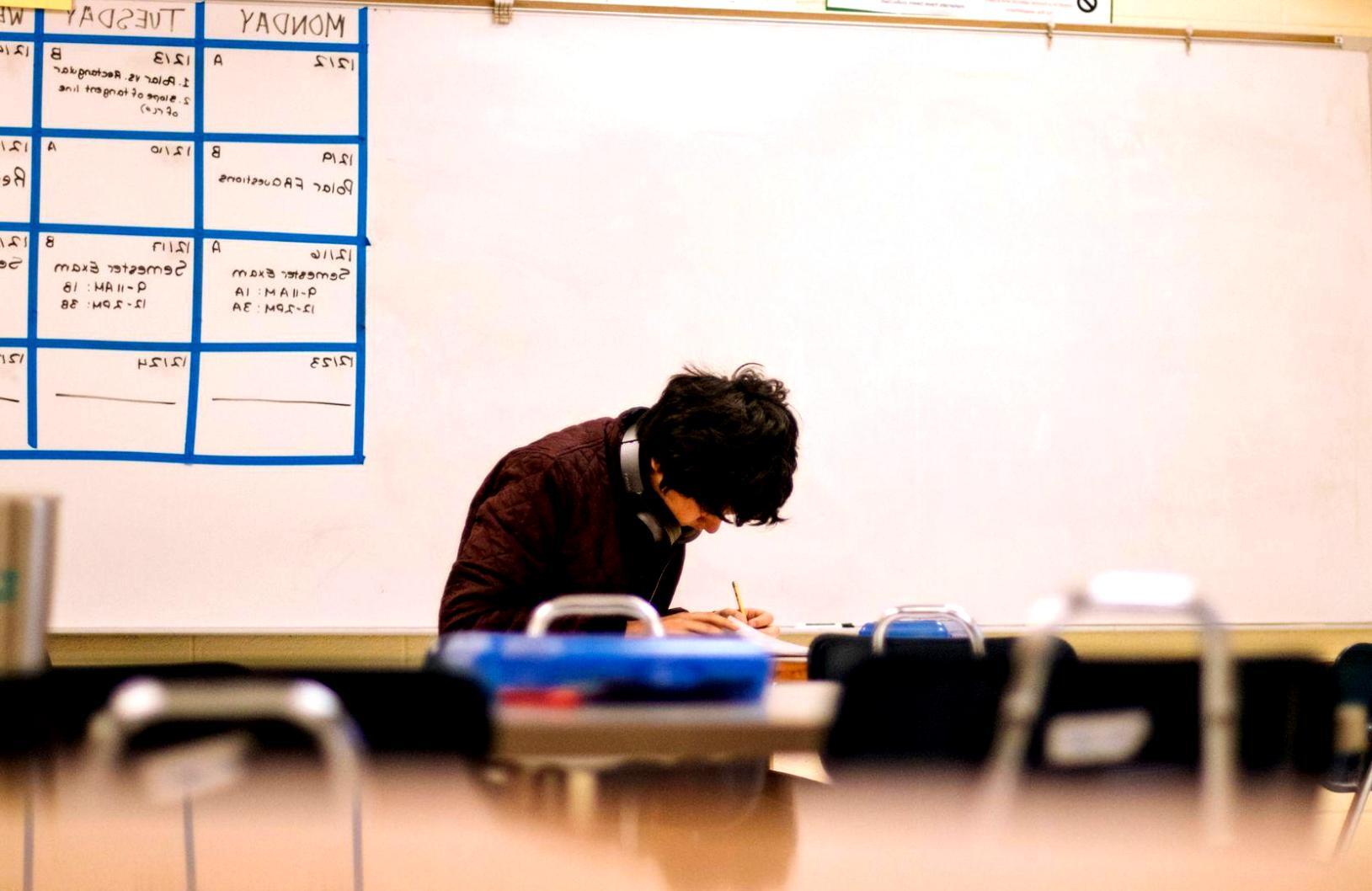

We keep group sizes small—usually 12 to 15 people. This isn't about exclusivity. It's because meaningful feedback on financial models takes time, and we're not interested in scaling to the point where participants become anonymous.

- We review every participant's work individually and provide written feedback

- Sessions happen in the evening because most of you work full-time

- We record everything so you can revisit complex topics when you need them

- Office hours are actual office hours—not automated responses or chatbots

Our next cohort starts in September 2025. We're planning to add a weekend intensive option by early 2026 for people who travel frequently for work.

Different Backgrounds, Shared Goals

We've worked with analysts from manufacturing firms trying to understand cash flow management, accountants transitioning into FP&A roles, and engineers moving into finance after years in operations.

What they share is a need for practical skills that translate directly to their work. Some are preparing for promotions. Others want to understand the finance side of their business better. A few are switching careers entirely and need to prove they can do the work.

Results vary because people start from different places and have different goals. But the feedback we care about most is when someone tells us they used something from our program in their actual job that week.

View Our Programs